DeFi NFTs: How They Work Together in the Web3 Economy

Why DeFi NFTs Are No Longer Separate Worlds

DeFi NFTs: Just a few years ago, DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens) lived in separate corners of the crypto ecosystem. DeFi was focused on financial tools like lending, staking, and yield farming, while NFTs were seen mostly as collectibles—digital art, profile pictures, and gaming assets.

Table of Contents

But in 2025, that division no longer exists.

NFTs are now being used within DeFi protocols, and DeFi tools are unlocking financial value from NFTs. This fusion is called “NFT-Fi”, and it’s enabling new use cases, investment strategies, and real-world applications. Instead of being art you “just hold,” NFTs can now be:

- Staked for yield

- Used as loan collateral

- Fractionalized and traded like fungible tokens

- Rented or lent in DeFi marketplaces

This evolution means NFTs are no longer just cultural assets—they’re also financial primitives in the Web3 economy.

The Rise of “NFT-Fi” in 2025

In 2025, NFT-Fi has emerged as one of the fastest-growing sectors in crypto. It’s a hybrid ecosystem where NFTs and DeFi intersect, creating powerful financial applications around digital ownership.

Here’s why NFT-Fi is taking off:

- Liquidity for Illiquid Assets: DeFi protocols allow users to unlock value from NFTs without selling them.

- Passive Income for NFT Holders: Platforms reward users for staking or lending their NFTs.

- New Investment Models: Fractional NFTs, rental marketplaces, and NFT index funds are making the space more accessible.

- Enhanced Utility: NFTs aren’t just static images—they’re programmable assets with built-in finance functions.

From blue-chip art collections to in-game items and real estate tokens, NFTs are now core components of decentralized finance infrastructures. The result? A seamless ecosystem where culture, identity, and capital meet on-chain.

2. What Is DeFi? What Are NFTs?

Before diving deeper into how they work together, let’s briefly break down the two pillars of NFT-Fi.

2.1 A Quick Refresher on DeFi (Decentralized Finance)

DeFi refers to a suite of blockchain-based financial tools and services that operate without intermediaries like banks or brokers. Instead, they use smart contracts—self-executing code on blockchains like Ethereum—to manage transactions.

🔹 Core Functions of DeFi:

- Lending & Borrowing: Users can earn interest or access crypto loans without credit checks

- Staking & Yield Farming: Earn rewards by locking tokens in liquidity pools or protocols

- Trading: Peer-to-peer swaps using decentralized exchanges (DEXs)

- Asset Management: Use of vaults, synthetic assets, and algorithmic strategies for passive income

The goal of DeFi is to create an open, permissionless, and transparent financial system that anyone can access.

2.2 What Makes NFTs Different?

NFTs (Non-Fungible Tokens) are unique digital tokens that represent ownership of a specific item or asset, and unlike cryptocurrencies like ETH or BTC, they are non-interchangeable.

Each NFT is:

- Unique: Has its own metadata, history, and attributes

- Indivisible: You can’t split an NFT into smaller units (unless fractionalized via DeFi)

- Verifiable: Stored on a blockchain, ownership and origin are public

🖼 Common Use Cases:

- Digital art & collectibles

- In-game items & avatars

- Virtual land & metaverse assets

- Event tickets, certificates, real-world property

NFTs are redefining digital ownership and identity—and in 2025, they’re becoming financial instruments through DeFi integration.

3. The Convergence of DeFi and NFTs

The boundaries between DeFi and NFTs have blurred, giving rise to an innovative ecosystem known as NFT-Fi—where NFTs are not just collectible assets, but functional tools within decentralized finance. Here’s how they’re working together in 2025:

3.1 NFT Collateralization

NFT holders can now unlock liquidity without selling their assets by using them as collateral for crypto loans.

🔹 How it Works:

- Users lock high-value NFTs (like BAYC, Azuki) in a lending protocol

- Borrowers receive stablecoins or ETH

- If loan terms aren’t met, the NFT can be liquidated

🔹 Popular Platforms:

- NFTfi

- Arcade

- BendDAO

This is a game-changer for holders who want to access capital without exiting their NFT positions.

3.2 NFT Staking and Yield Farming

Just like DeFi tokens, some NFTs can be staked to earn rewards or participate in protocol governance.

🔹 Use Cases:

- Staking a game NFT to earn in-game currency

- Staking profile picture (PFP) NFTs to earn governance tokens

- Loyalty NFTs earning you real-world perks or token airdrops

This transforms static NFTs into income-generating digital assets.

3.3 Fractional NFTs

High-value NFTs can be fractionalized into ERC-20 tokens, making them more liquid and accessible.

🔹 Benefits:

- Investors can own a piece of rare NFTs like CryptoPunks

- Fractional NFTs can be traded on DEXs or used in DeFi strategies

- Fractional ownership democratizes access to premium assets

Example: Owning 0.01 of a $100K NFT for $1,000.

3.4 NFT Rentals

NFT rental platforms allow users to temporarily lend or borrow NFTs for games, events, and metaverse access.

🔹 Applications:

- Borrowing a rare weapon for a tournament

- Renting a virtual plot of land in the metaverse

- Leasing an NFT for whitelist access or digital identity

Platforms like ReNFT and IQ Protocol lead this space in 2025.

3.5 NFT Indexes and Funds

To simplify exposure to NFTs, DeFi protocols now offer index tokens or DAO-curated vaults that represent multiple NFTs.

🔹 Benefits:

- Diversification across collections

- Passive exposure without managing individual NFTs

- Community governance over asset selection

Think of it as an ETF for NFTs—powered by DAOs.

4. Use Cases in the Web3 Economy

As NFTs and DeFi merge, they’re powering real, functional use cases across the broader Web3 ecosystem. Here’s how NFT-Fi is shaping digital economies in 2025:

4.1 In-Game Economies

NFTs are foundational in blockchain gaming, and DeFi brings financial mechanics that amplify earning potential and player engagement.

🔹 Key Uses:

- Lend in-game assets (weapons, land, avatars) to other players via NFT rental protocols

- Stake NFTs to earn in-game tokens or governance rights

- Use NFTs as collateral to borrow gaming capital (tokens, entry fees)

Example: Stake a rare game skin NFT to earn daily yield while you’re not using it.

4.2 Metaverse Finance

Metaverses like Otherside, Decentraland, and The Sandbox now use NFTs to represent virtual land, access passes, and identity—all tied to DeFi functions.

🔹 Applications:

- Borrow against virtual land NFTs for capital to build or host events

- Rent land plots or buildings inside metaverse spaces

- Stake metaverse NFTs to unlock premium access or exclusive experiences

Think of NFT real estate with DeFi mortgages and leasing options.

4.3 Creator & Fan Economies

NFT-Fi is transforming how creators and communities interact financially.

🔹 Monetization Models:

- Tokenize content as NFTs, then fractionalize for fans to invest in

- Use NFT royalties in DeFi vaults to generate passive yield

- Fans stake NFTs to support creators and earn backers’ rewards

Example: Musicians issue NFT albums; fans stake them to share streaming revenue.

5. Benefits of NFT-Fi Integration

The merging of DeFi and NFTs unlocks powerful advantages for users, builders, and investors in the Web3 ecosystem. Here’s why NFT-Fi is more than just a trend—it’s a financial evolution:

5.1 Unlocking Liquidity from Illiquid Assets

NFTs have traditionally been illiquid—you either sell them or let them sit. But DeFi tools now allow holders to:

- Borrow against NFTs without selling

- Fractionalize high-value NFTs for trading

- Rent out NFTs for short-term income

💡 This gives NFTs real financial flexibility—without losing ownership.

5.2 Passive Income Opportunities

NFT holders can now earn yield like DeFi token holders through:

- Staking NFTs for token rewards

- Participating in yield farms powered by NFT ownership

- Leasing NFTs to other users (e.g. in games, events, metaverses)

Holding a good NFT no longer just looks cool—it pays.

5.3 Financial Utility Enhances Value

When NFTs have DeFi features built-in, their value increases beyond aesthetics or hype:

- Real-world utility = more use cases = higher demand

- Adds floor price stability through liquidity access

- Encourages long-term holding instead of flipping

A stakable, rent-able NFT has cash flow potential, not just resale value.

5.4 Expanding Access and Inclusivity

Fractional NFTs and NFT index tokens allow:

- Small investors to gain exposure to blue-chip collections

- Communities to co-own valuable assets

- DAOs to govern and manage shared NFT vaults

Web3 becomes more open, fair, and decentralized, just as it was meant to be.

6. Risks and Limitations

While NFT-Fi offers powerful innovation, it also comes with real risks—especially for users who aren’t fully informed. Below are the key challenges and limitations to watch out for in 2025:

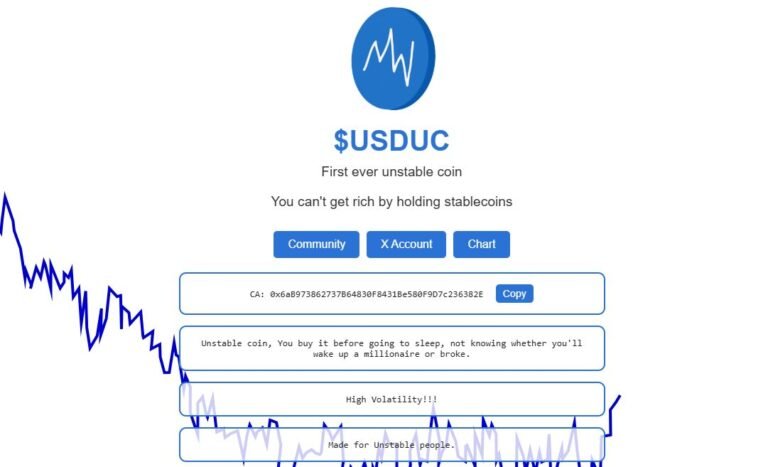

6.1 Price Volatility of NFT Collateral

NFT values are highly speculative and illiquid, meaning:

- Sudden floor price drops can lead to liquidation of loans

- Borrowers may lose valuable NFTs due to short-term dips

- Oracles used to determine NFT value may not be accurate or fast enough

❗ Always over-collateralize and understand the protocol’s liquidation rules.

6.2 Smart Contract Vulnerabilities

NFT-Fi relies on complex smart contracts, which are not immune to bugs or exploits:

- Protocols can be hacked, leading to total asset loss

- Approvals and interactions can be manipulated (e.g., phishing drainer contracts)

- Even audited platforms may have security blind spots

Tip: Use hardware wallets, revoke unused approvals, and stick to trusted protocols.

6.3 Low Liquidity in Niche Collections

Not all NFTs can be easily used in DeFi:

- Only blue-chip or whitelisted NFTs are accepted on lending platforms

- Niche projects may have poor price discovery and low demand

- Exit liquidity can dry up quickly in a downtrend

DeFi utility is mostly limited to high-profile NFTs (e.g., BAYC, Azuki, Pudgy Penguins).

6.4 Regulatory and Legal Risks

NFT-Fi raises questions regulators are still grappling with:

- Are fractional NFTs considered securities?

- What’s the tax treatment of NFT income or loans?

- Will KYC and AML become mandatory for NFT lending platforms?

Lack of clarity can lead to project shutdowns or sudden restrictions.

7. Final Thoughts: DeFi + NFTs = The Foundation of Web3 Finance

In 2025, the line between NFTs and DeFi has all but disappeared. Together, they form the backbone of a new kind of financial system—NFT-Fi—that combines culture, utility, and capital into one powerful ecosystem.

✅ What We’ve Learned:

- NFTs are no longer just collectibles—they’re programmable financial assets

- DeFi tools like lending, staking, and fractionalization have unlocked new value layers

- Use cases are expanding across gaming, metaverse, creator economies, and real-world assets

- Risks remain, but knowledge, diversification, and security practices help mitigate them

🚀 How to Get Started in NFT-Fi

- Choose a trusted NFT with DeFi utility (e.g., staking, collateral, governance)

- Use secure wallets and platforms (Ledger, MetaMask + verified protocols like NFTfi, ReNFT)

- Start small—test with minor funds and learn how each feature works

- Stay informed with tools like Dune Analytics, Nansen, and DeFiLlama

🔭 What’s Next?

NFT-Fi is just the beginning. As regulations evolve, chains scale, and UX improves, we’ll likely see:

- Tokenized real estate and luxury goods fully tradable on DeFi

- AI-driven NFT assets that adapt to market or user behavior

- More institutional-grade NFT protocols with compliant frameworks

In short: DeFi and NFTs aren’t just merging—they’re co-building the financial layer of the internet.

Read Also: NFTs in 2025: Trends, Market Stats & Top Collections