Best BNB-Based Tokens That Outperformed the Market

1. Why BNB-Based Tokens Deserve Attention

The Rise of BNB Chain in the Crypto Ecosystem

Since its launch by Binance, the BNB Chain (formerly Binance Smart Chain) has emerged as a powerful force in the blockchain world. It was designed to provide a scalable, low-cost alternative to Ethereum, and it quickly gained traction among developers and users alike. Today, BNB Chain supports thousands of dApps, DeFi protocols, NFTs, and Web3 projects—making it one of the most active and vibrant ecosystems in the industry.

Table of Contents

High Performance, Low Fees, and Growing Adoption

One of the biggest reasons BNB-based tokens continue to outperform the market is the chain’s unmatched efficiency. With transaction fees that are a fraction of those on Ethereum and near-instant confirmation times, BNB Chain is ideal for high-frequency DeFi trading, yield farming, GameFi, and microtransactions. As more users and developers migrate to the BNB ecosystem, native tokens built on the chain benefit from increased liquidity, visibility, and network effects.

2. What Makes a Token “Outperform” the Market?

Key Metrics: ROI, Utility, Community Growth

Outperformance in the crypto world isn’t just about price pumps—it’s about sustained growth and value delivery. The best-performing BNB-based tokens typically excel in three core areas:

- Return on Investment (ROI): A strong ROI over weeks or months shows a token’s ability to deliver consistent gains, even in volatile conditions. It’s a sign of investor confidence and market resilience.

- Utility: Tokens with real use cases—whether in DeFi, GameFi, or governance—tend to retain and grow their value over time. Utility creates demand beyond speculation.

- Community Growth: An active and growing user base often correlates with healthy market behavior. A vibrant community fuels adoption, promotes holding, and encourages developer support.

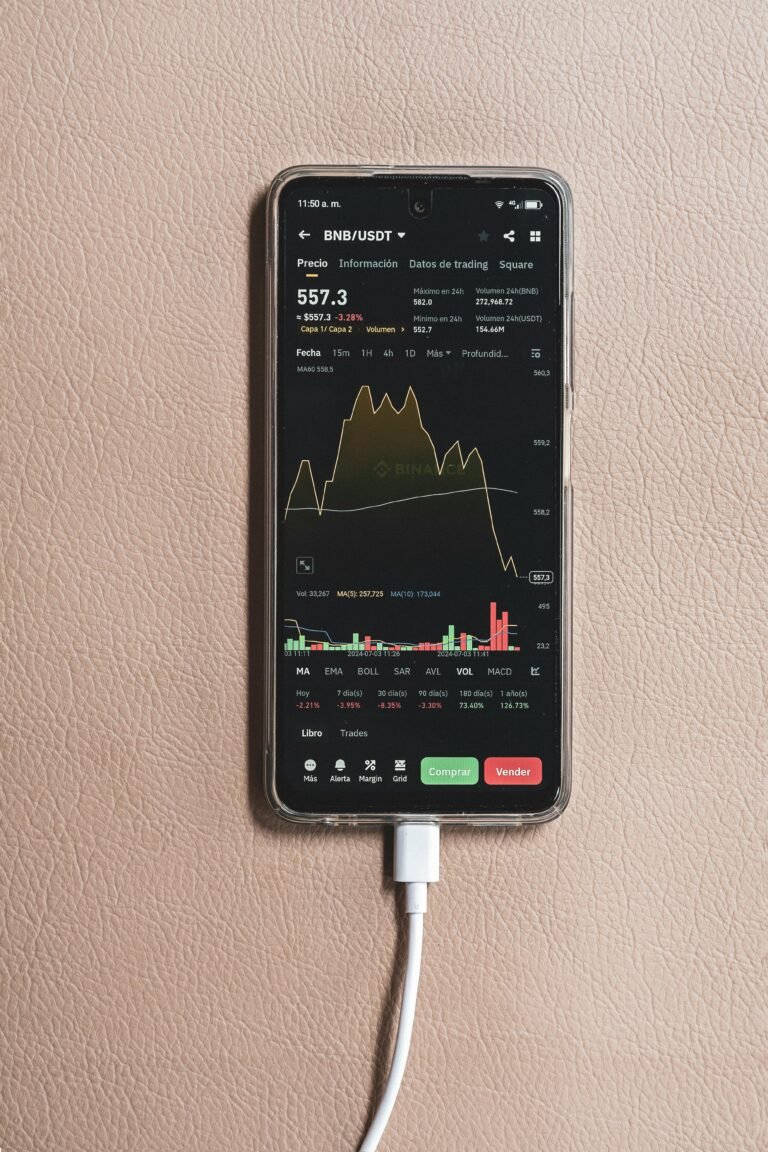

Comparing Performance Against BTC, ETH, and BNB

To truly gauge outperformance, it’s essential to measure a token’s gains not just in USD, but against major benchmarks like Bitcoin (BTC), Ethereum (ETH), and even BNB itself. Why? Because these assets represent the crypto “index” by which most altcoin performance is judged.

For example:

- A token that doubles in value while BTC remains flat is clearly outperforming.

- A token that outpaces BNB in the same time period may indicate superior traction within its own ecosystem.

3. Top Performing BNB-Based Tokens in 2024–2025

3.1 PancakeSwap (CAKE) – The DeFi Pioneer

As the first major DEX on BNB Chain, PancakeSwap continues to lead in volume, user activity, and DeFi innovation. In 2024, the CAKE token surged due to key upgrades like cross-chain swaps, perpetual trading, and revamped tokenomics with reduced inflation.

- Why it Outperformed: Massive liquidity, utility across DeFi and NFTs, and steady burns.

3.2 Venus (XVS) – Leading Decentralized Lending Protocol

Venus remains the go-to money market on BNB Chain, enabling decentralized borrowing and lending of crypto assets. In 2025, it gained traction with its integration of real-world assets (RWAs) and stablecoin collateral.

- Why it Outperformed: Real yield, governance influence, and growing institutional interest.

3.3 Alpaca Finance (ALPACA) – Leverage Without Liquidation

This yield farming platform offers leveraged yield strategies without risking liquidation. It attracted users in the bear market with its low-risk, high-reward DeFi mechanics.

- Why it Outperformed: Sustainable tokenomics, strong TVL growth, and security-first design.

3.4 Hooked Protocol (HOOK) – Web3 Education & Mass Adoption

Hooked Protocol introduced a learn-to-earn model that gained massive adoption in developing countries. With gamified learning and practical onboarding for Web3 tools, HOOK became a top performer.

- Why it Outperformed: Explosive user growth, viral referral mechanics, and real-world utility.

3.5 Helio Protocol (HAY) – Real-Yield Stablecoin Innovation

Helio’s HAY stablecoin gained ground due to its overcollateralized model and yield-earning design. With growing DeFi integrations and low peg volatility, HAY and the HELIO token saw sustained demand.

- Why it Outperformed: Low volatility, DeFi integrations, and rewards for stability providers.

4. Honorable Mentions: Emerging BNB Gems

While the top performers stole the spotlight, several emerging BNB-based tokens showed impressive momentum and could be the next breakout stars. These honorable mentions may not have the same market cap as the leaders—but they’ve demonstrated strong fundamentals and loyal communities.

Baby Doge Coin (BABYDOGE) – Meme Power Meets Utility

Initially launched as a meme token, Baby Doge has matured into a serious contender. With its auto-burn mechanism, charity tie-ins, and growing DeFi integrations, it continues to trend on social media and outperform market expectations.

- Why It’s Notable: Massive following, regular burns, and real use cases in payments and DeFi.

Beefy Finance (BIFI) – Cross-Chain Yield Optimization

Beefy Finance provides yield optimization across multiple blockchains, including BNB Chain. By auto-compounding yields from a range of DeFi protocols, BIFI offers passive income strategies with compounding power.

- Why It’s Notable: Cross-chain capability, high APYs, and long-term credibility.

Mobox (MBOX) – GameFi and NFT Fusion

Mobox blends gaming, NFTs, and DeFi into a play-to-earn metaverse. With new game launches, staking rewards, and NFT farming, it continues to grow a dedicated player base.

- Why It’s Notable: Strong NFT utility, gamified token economics, and developer consistency.

Ultiverse (ULTI) – AI + Metaverse Innovation

Combining AI-driven avatars and metaverse infrastructure, Ultiverse is one of the more futuristic BNB-based projects. It gained traction with strategic partnerships and a strong focus on user-generated content.

- Why It’s Notable: AI + Web3 synergy, immersive gameplay, and ecosystem-building potential.

5. Key Factors Behind Their Outperformance

Understanding why these BNB-based tokens succeeded can help identify future winners. Here are the key traits that set them apart from the rest of the market:

5.1 Active Development & Transparent Roadmaps

Tokens that outperformed consistently had strong developer activity. Frequent GitHub commits, clear roadmap updates, and prompt bug fixes gave users and investors confidence in the project’s future.

- Example: PancakeSwap’s transition to v3 and support for perpetual trading made CAKE relevant again.

- Takeaway: Development signals project health and long-term vision.

5.2 Real Use Cases & Ecosystem Integration

Tokens with real-world or platform-level utility fared far better than purely speculative assets. Whether used for trading fees, staking, governance, or in-game economies, these tokens had demand beyond hype.

- Example: Venus (XVS) thrives as a core DeFi lending token on BNB Chain.

- Takeaway: The more reasons people have to use your token, the stronger its market position.

5.3 Strong Community & Social Momentum

A large, engaged community can drive token awareness, liquidity, and long-term holding behavior. Tokens that outperformed often went viral on Twitter, Telegram, and TikTok, attracting new users through network effects.

- Example: Baby Doge Coin rode community memes and social campaigns to sustained visibility.

- Takeaway: Community-driven projects often outperform even without massive VC backing.

5.4 Exchange Listings & Strategic Partnerships

Being listed on major centralized exchanges (like Binance, Gate.io, or KuCoin) boosted accessibility and trust. Many outperforming tokens also formed partnerships that expanded their ecosystems or user base.

- Example: Helio Protocol gained traction through integrations with popular BNB DeFi apps.

- Takeaway: Access + credibility = volume and adoption.

6. How to Identify the Next Market Beaters on BNB Chain

If you missed the last wave of outperformers, don’t worry—the next gems are already forming. Here’s how to spot future winners early in the BNB ecosystem.

6.1 Watch On-Chain Metrics Early

Blockchain data doesn’t lie. Look for signs of growth such as:

- Increasing unique wallet addresses

- Rising total value locked (TVL) on dApps

- Surging daily active users (DAU)

Tools like DefiLlama, BscScan, and DappRadar can help track this activity in real time.

6.2 Track Developer Activity and Product Releases

Projects with frequent GitHub commits, bug bounty programs, and shipping products ahead of deadlines show strong team execution. Check for:

- Transparent GitHub repos

- Dev logs and public product updates

- Audits from firms like CertiK or Hacken

6.3 Look for Unique Utility and Problem-Solving

Tokens that solve real problems or create new categories often outperform. Ask yourself:

- Does this token power a useful product?

- Is the problem it solves significant in Web3 or DeFi?

- Is the token model sustainable (not just inflationary)?

6.4 Monitor Social Signals and Sentiment

An engaged, growing community is often a precursor to price action. Use:

- X (Twitter) and Telegram for sentiment analysis

- Tools like LunarCrush, Santiment, or DexTools for early hype indicators

- Engagement rates > vanity metrics like follower count

6.5 Be Early on Testnets and Incentivized Campaigns

Many successful tokens begin with testnet airdrops or incentivized campaigns. Participating early gives you access before the masses.

- Example: Hooked Protocol’s testnet campaign rewarded early learners with HOOK token airdrops.

7. Risks and Red Flags to Consider

While chasing outperforming BNB-based tokens can be lucrative, it also comes with real risks. Identifying warning signs early can help you avoid costly mistakes.

7.1 Volatility Despite Outperformance

Just because a token has outperformed in the past doesn’t mean it’s immune to sudden drops. Many BNB-based tokens experience sharp corrections after major rallies.

- Tip: Use trailing stop-losses or partial profit-taking strategies to manage risk.

- Watch out: Parabolic price charts with no strong support levels often signal a blow-off top.

7.2 Smart Contract Vulnerabilities & Exploits

The BNB Chain has seen its fair share of rug pulls and exploits. Unverified or unaudited smart contracts can drain user funds or have hidden backdoors.

- Red Flags: Lack of third-party audits, anonymous devs, or copy-pasted code.

- Do This Instead: Stick to tokens that are audited by reputable firms and open-source on GitHub.

7.3 Unsustainable Tokenomics

Tokens with high inflation, no burn mechanism, or poor utility often dump after hype fades. Many projects over-incentivize early users only to run into liquidity or trust issues later.

- Watch for: Emission schedules that flood supply, weak staking mechanics, or no clear long-term value for holders.

7.4 Regulatory Risks

As global scrutiny over crypto grows, some tokens—especially DeFi and privacy-related ones—may face regulatory pressure. Projects without compliance or proper disclosures may become inaccessible or delisted.

- Tip: Research whether a project complies with KYC, AML, and legal norms in your region.

- Caution: Tokens tied to anonymous teams or unregistered fundraising can be higher risk.

8. Conclusion: Stay Ahead with BNB-Based Winners

BNB Chain continues to prove itself as a hub for innovation, scalability, and real-world crypto adoption. While countless tokens launch on the network, only a select few truly outperform the market—driven by strong fundamentals, active communities, and real utility.

By studying the success patterns of top-performing tokens like PancakeSwap, Venus, Helio, and others, investors can learn to spot promising projects early. But with high reward comes high risk—so it’s crucial to combine technical analysis, community insights, and smart risk management.

Stay informed, stay early, and always do your own research (DYOR). The next big BNB-based winner might already be gaining traction—you just need to know where to look.

9. FAQs

Q1: Are BNB-based tokens safer than tokens on other chains?

Not necessarily. While BNB Chain offers fast and cheap transactions, the safety of a token depends more on its smart contract security, developer transparency, and community trust than the blockchain it’s built on.

Q2: How can I buy top-performing BNB tokens?

You can buy most BNB-based tokens on Binance, PancakeSwap, or other decentralized exchanges (DEXs) that support BEP-20 tokens. Always verify the contract address to avoid scams.

Q3: What’s the best wallet for holding BEP-20 tokens?

Popular options include:

- MetaMask (with BNB Chain added)

- Trust Wallet

- SafePal

These support BEP-20 tokens and are compatible with most DeFi platforms on BNB Chain.

Q4: Can meme coins on BNB Chain also outperform the market?

Yes, meme tokens like Baby Doge Coin have outperformed due to strong social hype and loyal communities. However, they carry higher volatility and risk, so approach with caution.

Q5: How do I check if a BNB token is safe to invest in?

Look for:

- Audit reports (CertiK, Hacken, etc.)

- Transparent team and roadmap

- Tokenomics and utility

- Community sentiment

Use platforms like BscScan, RugDoc, and TokenSniffer to analyze projects before investing.

Read Also: Top 10 BNB Chain Projects You Should Know in 2025